Belotra Insights

Explore the latest trends and news across various topics.

Withdrawal Maze: Navigating Methods and Fees Like a Pro

Unlock the secrets to hassle-free withdrawals! Discover methods, fees, and pro tips to navigate the withdrawal maze effortlessly.

Understanding Withdrawal Fees: What You Need to Know Before You Cash Out

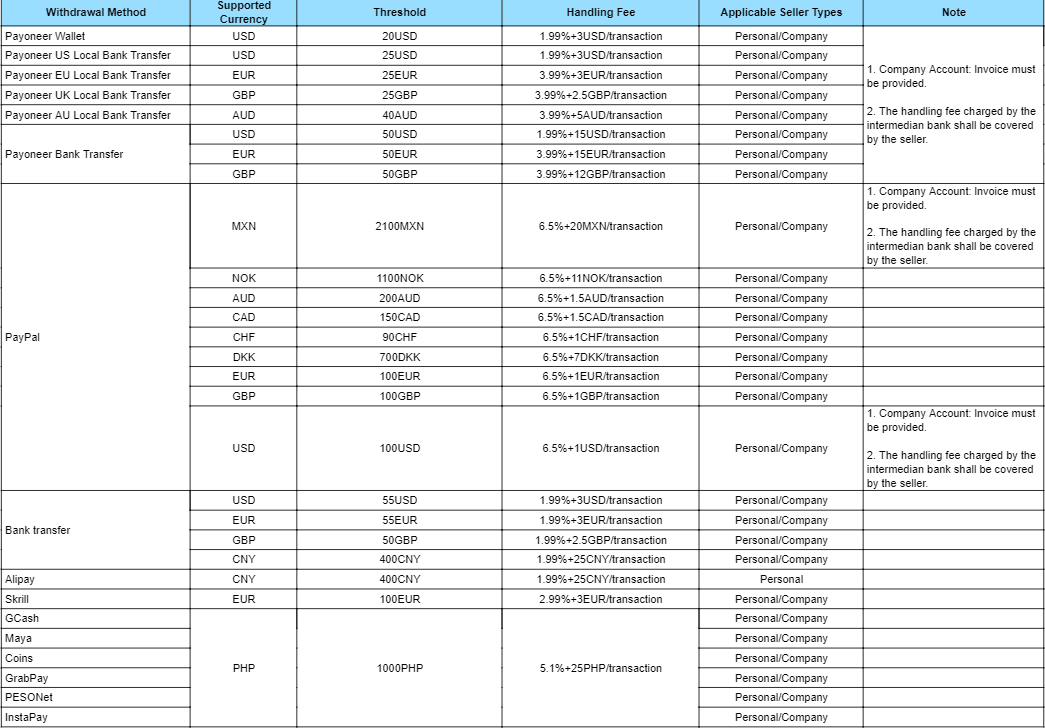

Understanding withdrawal fees is essential for anyone engaging in online financial transactions, especially when cashing out from investment platforms, casinos, or cryptocurrency exchanges. These fees can vary significantly between different platforms and can impact your overall profit margins. Before making a withdrawal, it is crucial to read the terms of service and fee structures provided by the platform. Some common factors that influence withdrawal fees include:

- The payment method you choose (e.g., bank transfer, credit card, e-wallet).

- The total amount being withdrawn.

- Your account status or membership level.

It is also advisable to be aware of any potential hidden fees that might apply during the withdrawal process. Some platforms may advertise low withdrawal fees but apply additional charges for currency conversion or processing fees. To avoid unexpected costs, consider reaching out to customer support for clarification on any unclear terms. Ultimately, having a solid understanding of withdrawal fees will help you make informed decisions, ensuring that you maximize your cash-out amount while minimizing unnecessary expenses.

Don't miss out on the exciting offers available through the duel promo code that can enhance your gaming experience and provide fantastic rewards.

Top 5 Withdrawal Methods Compared: Find the Right One for You

When it comes to choosing the ideal withdrawal method for your online transactions, understanding your options is crucial. In our Top 5 Withdrawal Methods Compared guide, we delve into the advantages and disadvantages of each method to help you find the right one for your needs. The five methods we'll discuss include bank transfers, e-wallets, cryptocurrencies, checks, and prepaid cards. Each method varies in processing time, fees, and accessibility, making it essential to evaluate which aligns best with your financial strategy.

1. Bank Transfers: Known for their reliability, bank transfers typically come with a longer processing time but are highly secure.

2. E-Wallets: Fast and convenient, e-wallets like PayPal and Skrill offer instant access to funds but may incur transaction fees.

3. Cryptocurrencies: As an emerging choice, cryptocurrencies allow for quick withdrawals and lower fees, although they can be volatile.

4. Checks: Traditional and straightforward, checks can be less convenient due to postal delays.

5. Prepaid Cards: Offering the flexibility of spending without a bank account, prepaid cards are ideal for those who prefer a physical method but can have activation fees.

Navigating Withdrawal Limits: Tips to Maximize Your Transactions

Navigating withdrawal limits can be a daunting task for many users, particularly in the world of online banking and cryptocurrency exchanges. To maximize your transactions, it's essential to understand the policies set by your bank or platform. Take the time to familiarize yourself with the specific withdrawal limits applicable to your account. These limits may vary based on factors such as account type, verification status, and transaction history. By keeping track of these details, you can plan your transactions more effectively and avoid unnecessary delays or fees.

In addition to knowing your withdrawal limits, consider implementing a strategy for managing your withdrawals. Here are some tips to streamline the process:

- Schedule Withdrawals: Plan regular withdrawals instead of waiting until you need a large sum, which could exceed your limits.

- Utilize Multiple Accounts: If possible, consider using multiple accounts across different platforms to diversify your limits.

- Stay Informed: Regularly check with your financial institution for any changes to withdrawal policies or limits.

By following these tips, you can effectively navigate withdrawal limits and maximize your transactions with minimal hassle.